Getting Loan From Lending Club Without Uploading Tax

Editor's note: NerdWallet'southward Step by Step series gives modest-business owners a backside-the-scenes look at the loan application process for diverse online lenders. Nosotros prove you what you tin expect screen by screen as yous submit your application.

Table of contents

Lending Order loan awarding summary

Pre-qualification

Loan quote

Providing business bank business relationship information

Submitting required documents

Verifying email address, bank account

Last review and funding

To apply at Lending Club

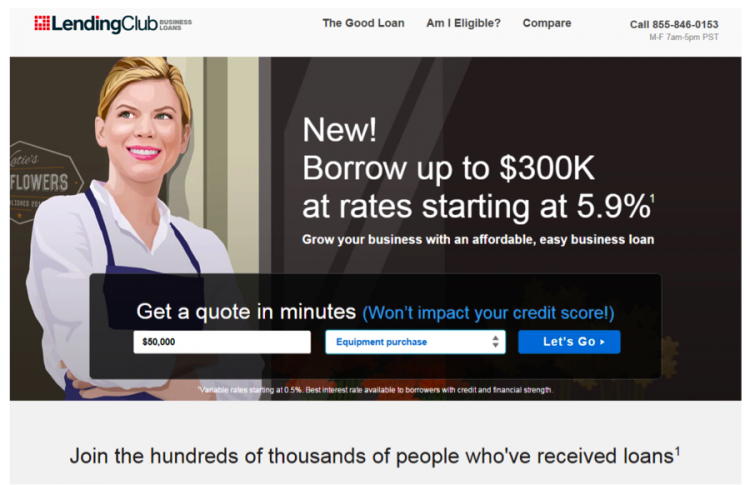

50ending Club, which began offering business loans in early 2014, is a skilful option for business owners who prefer the convenience of online lending and those who can't wait several months for a depository financial institution loan or don't qualify due to less-than-perfect credit.

NerdWallet is a free tool to discover you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines. Start here to maximize your rewards or minimize your interest rates. Steve Nicastro

![]()

Lending Club

Exercise you qualify?

- Annual acquirement is $75,000+

- Personal credit score of 600

- ii years in business

Lending Club loan application: Summary

- Time: Pre-qualification can take as piffling as v minutes. If yous pre-qualify, you must gather and submit supporting documents. Subsequent funding takes about a week.

- Documents needed:

- Almost contempo iii months of business bank account statements

- IRS Grade 4506-T, which authorizes Lending Club to obtain your business concern's tax transcripts from the IRS

- Previous yr's business tax return

Note: Lending Club is unavailable to borrowers in Iowa and Idaho.

Lending Lodge loan application: Step past pace

1. Pre-qualification

Time: 5 minutes

Time: 5 minutes

Documents needed? No

Potential borrowers can become a rate quote for a Lending Guild loan in about five minutes without affecting their credit scores.

First, y'all'll enter your desired loan amount and explain why yous demand the money. You lot can choose amid debt consolidation, an inventory or equipment buy, working capital, remodeling, business acquisition, marketing, or emergency repairs, or you can manually enter some other concern purpose. The visitor provides up to $300,000 for loans.

Y'all'll and so exist asked for some bones data almost your business — including its address, telephone number, number of employees and legal structure (limited liability company, C or S corporation, sole proprietorship or partnership) — and create a Lending Lodge login with password.

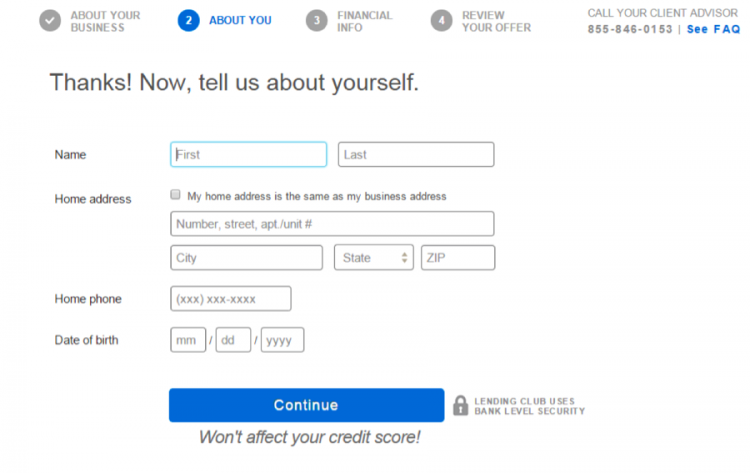

Next, Lending Club volition ask you for some personal information:

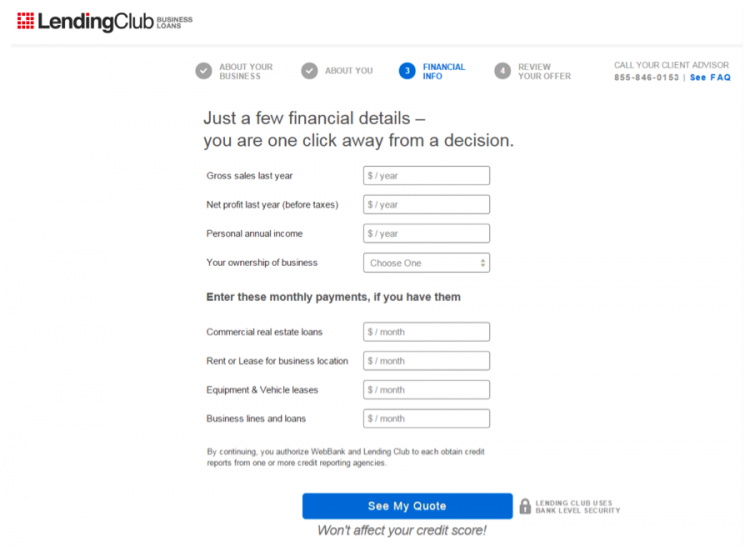

Earlier you receive your quote, you'll provide fiscal details most your business: gross sales in the last year, net profit before taxes, personal annual income, pct buying of the business concern, and monthly payment amounts for any commercial real estate loans or leases, equipment and vehicle leases, and other business lines and loans.

Lending Club will check your credit afterward y'all consummate this step — but because it'southward a "soft pull," not a hard inquiry, information technology won't lower your credit score. (Note: Your credit score will exist affected if you lot go approved and have the loan.) The boilerplate credit score of its borrowers is nigh 700, according to Lending Club.

2. Loan quote

Time: Instant

Time: Instant

Documents needed? No

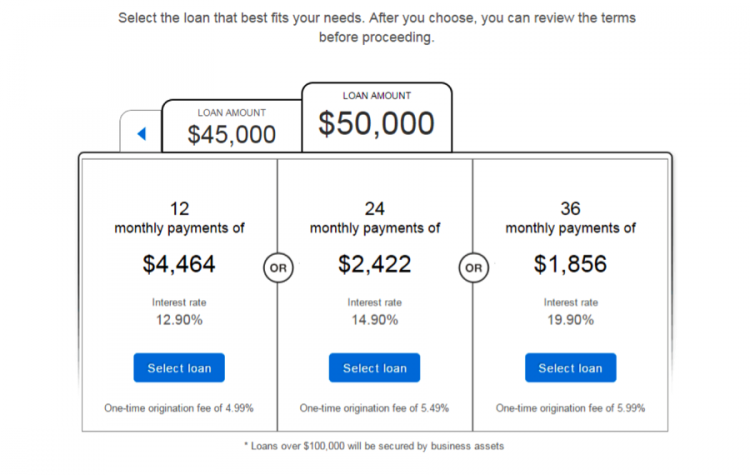

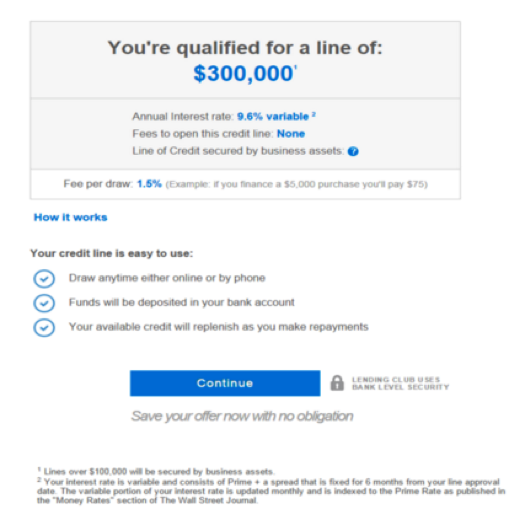

If you lot pre-authorize for the term loan, Lending Club will immediately quote you a loan amount and three repayment terms: 12, 24 or 36 months. Y'all'll see the interest charge per unit for each, as well as a 1-time origination fee — a percentage between .99% and 6.99% that will be deducted from your loan proceeds — and your fixed monthly payment amount.

Nerd note:Remember the interest rate alone does not stand for the true cost of borrowing. The annual percentage rate, or April, represents all borrowing costs, which include interest rates, origination fees and whatsoever other charges.

This quote should stick unless Lending Society can't verify the information on your application, says Tom Green, Lending Club's vice president of small-concern lending. "For about borrowers," he says, "the pre-qualification quote received is exactly what they get."

If you cull a shorter repayment term, you'll have a higher monthly payment, but a lower interest rate; longer repayment terms carry a lower monthly payment and a college involvement rate.

If you don't authorize, Lending Order will tell you lot immediately and provide a reason for the denial. Yous can apply again if yous later meet the company'south requirements; you won't be penalized if y'all were denied in the past.

If you utilise for a loan of more than $100,000, Lending Club requires collateral in the form of a UCC-1 lien on your business assets. This ways that Lending Club has priority over other lenders to compensate its debt if your business defaults.

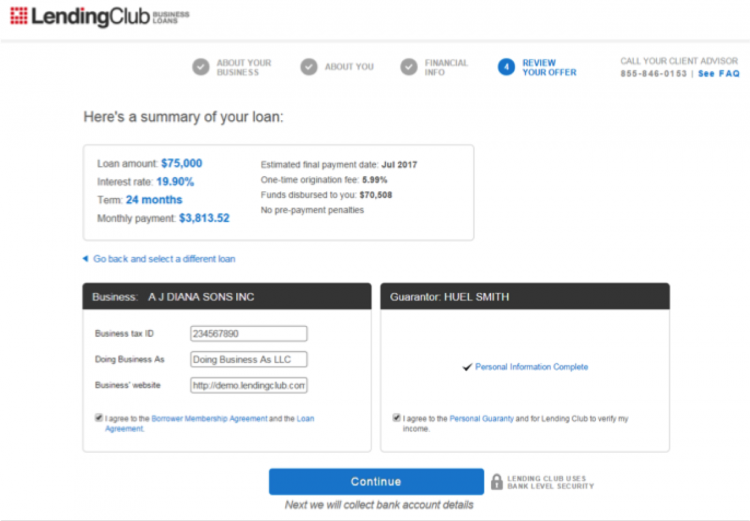

On the adjacent page, you'll receive more than details near your offer, including the estimated terminal payment date and the total corporeality of funds you'll receive upon closing, factoring in the origination fee.

In this case, a loan amount of $75,000 and an origination fee of five.99% (or $iv,492.50) leaves the borrower with $seventy,508 at closing. The borrower will pay an involvement rate of 19.90% over the 24-month loan term, with monthly payments of $3,813.52. The APR in this example is 26.42%.

On this screen, you likewise need to enter your business organization's taxation ID, corporate structure and the address of its website, and sign off on a personal guaranty. Read the document by clicking the link, and then bank check off the box. The guaranty is in addition to the UCC-1 lien. Information technology holds you personally responsible for repayment in the consequence that the business fails to repay the loan, or your assets fail to cover a default.

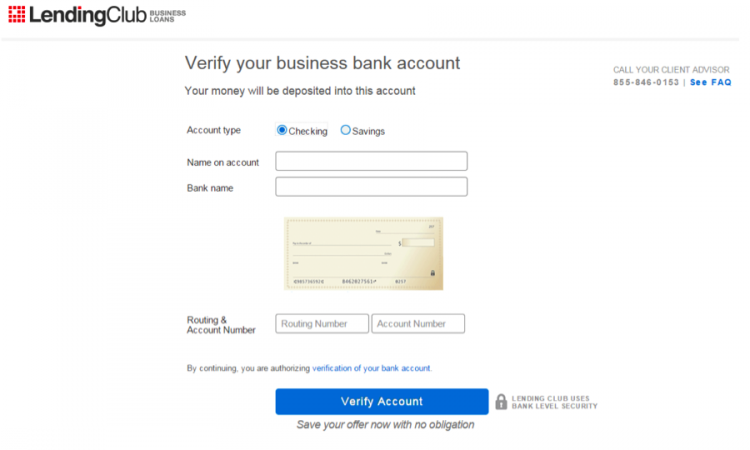

3. Provide bank account information

Time: A few minutes

Time: A few minutes

Documents needed? No

I due north this step you tin can choose to accept your loan deposited into either a business checking or savings account. Provide the name of the bank, the proper noun on the account, and its routing and account numbers. (The business relationship is verified in Step v.)

This is also the account from which Lending Club will withdraw your payments; you can change information technology later if you demand to, Greenish says.

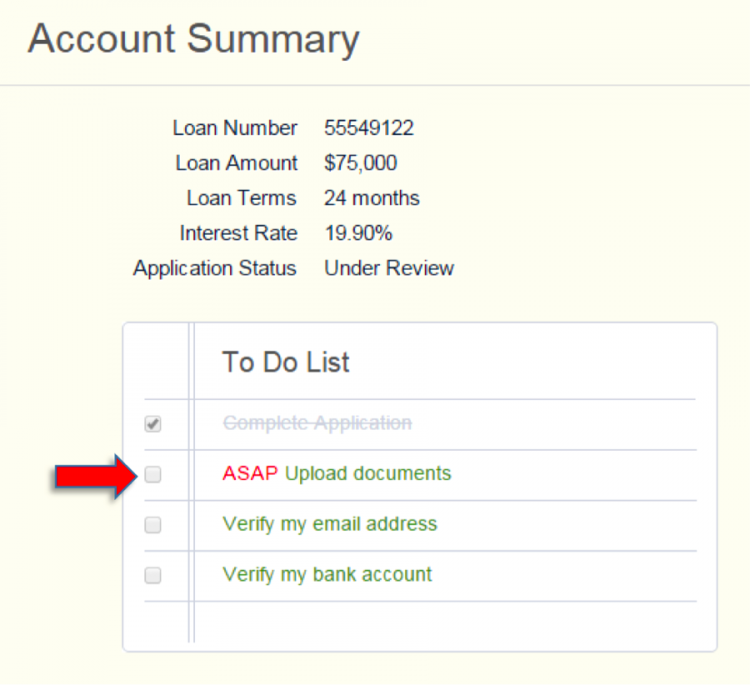

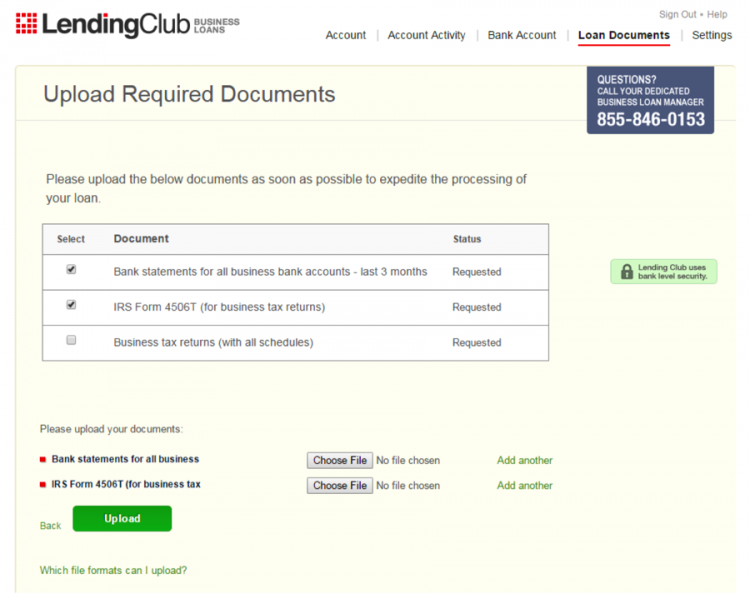

4. Submit required documents

Time: Less than an hour, if you're fix to submit the required documents digitally

Time: Less than an hour, if you're fix to submit the required documents digitally

The longest delay in this step tends to be for borrowers who don't have copies of their tax returns and need to become them from an accountant, according to Light-green. Emailing or faxing the documents likewise tin can add time to the process, but 60% of the company'south borrowers use one of those two methods.

Documents needed: Concern bank statements for the last 3 months, an IRS Course 4506-T for business tax returns, and the previous years' business taxation return.

Documents needed: Concern bank statements for the last 3 months, an IRS Course 4506-T for business tax returns, and the previous years' business taxation return.

Your application is under review while you submit the documents.

Nerd note: Lending Club recently instituted a "small ticket policy" that reduces the number of documents business organization owners need to provide if they're applying for loans of $five,000 to $15,000. Some borrowers may not take to provide any. This shortens the overall time to funding.

If yous have questions at this point, y'all can call a business loan manager at the number in the elevation right corner of the screen.

To fax, simply click the "demand to fax" link to the left of the upload button. You lot'll need to impress a cover sheet that contains the fax number and other important information Lending Club requires to process the loan documents.

To fax, simply click the "demand to fax" link to the left of the upload button. You lot'll need to impress a cover sheet that contains the fax number and other important information Lending Club requires to process the loan documents.

One time yous've faxed the documents, information technology should take three business organization days to receive an update on your loan status.

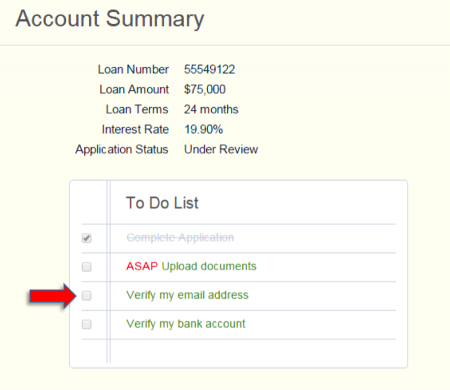

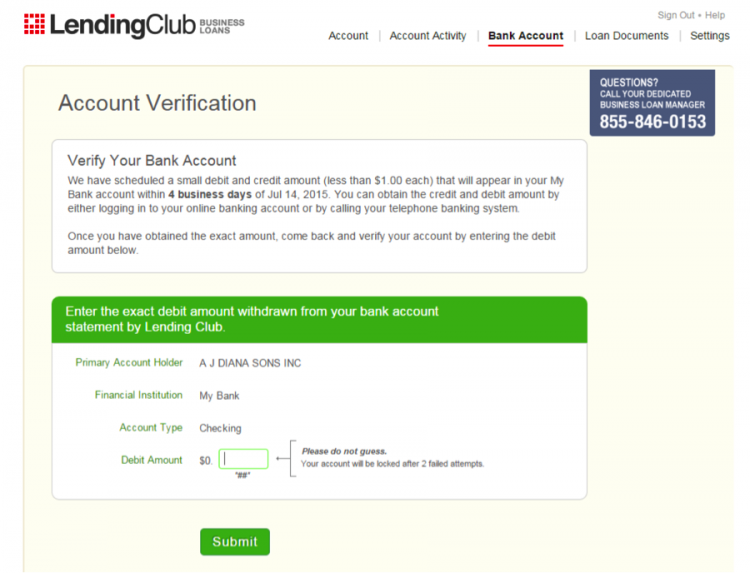

5. Verify e-mail address, bank account

Fourth dimension: ane day

Fourth dimension: ane day

Documents needed? No

The next footstep is to verify your email address and bank account.

Lending Gild will transport you lot an electronic mail verification; ostend your address using the link in the email.

Lending Gild will transport you lot an electronic mail verification; ostend your address using the link in the email.

To verify your banking information, Lending Lodge will make a debit and credit of less than $1 each to the bank account you provided within four business organisation days — although it usually happens on the adjacent twenty-four hour period, according to Green. When the debit and credit amounts appear, log in to report them to Lending Lodge.

To verify your banking information, Lending Lodge will make a debit and credit of less than $1 each to the bank account you provided within four business organisation days — although it usually happens on the adjacent twenty-four hour period, according to Green. When the debit and credit amounts appear, log in to report them to Lending Lodge.

After verifying your business relationship, you'll have access to a tab called "Loan Documents" that contains your borrower membership agreement, commercial loan agreement, and the personal guaranty you signed during the application. You lot can view them, simply in that location's cypher you need to do with them at this phase.

If you click on the "Settings" tab, you tin view your user profile, which includes your personal and business information.

Final review and funding

Time: Five to seven days

Time: Five to seven days

Documents needed? No

Lending Guild now performs a terminal review of your application. If the company can verify your information and believes you're able to repay the loan, it will offer y'all funding. If y'all accept, Lending Club will brand a hard inquiry on your credit written report.

![]() In one case that's complete, the loan is ready to fund. Lending Club will call to let you know that the coin is on the style and to respond whatsoever final questions you may have.

In one case that's complete, the loan is ready to fund. Lending Club will call to let you know that the coin is on the style and to respond whatsoever final questions you may have.

Funds are typically sent within five days, but may not be bachelor in your depository financial institution account for another day or two, Dark-green says. Larger loans may take a week or more due to a longer review procedure, he says.

To apply

If yous're fix to get started with Lending Club, apply on the lender'southward secure site:

Find and compare small-business organisation loans

NerdWallet has come with a listing of the best small-business loans to run across your needs and goals. We gauged lender trustworthiness, market telescopic and user experience, amongst other factors, and bundled the loans by categories that include your revenue and how long you've been in concern.

Compare business organization loans

The post was updated June 30, 2016. The mail was originally published on Feb. one, 2016.

Steve Nicastro is a staff writer at NerdWallet, a personal finance website. Email: Steven.N@nerdwallet.com. Twitter: @StevenNicastro .

The commodity Step by Step: Lending Club Business Loan Awarding in Existent Time originally appeared on NerdWallet.

dalgleishmandearer.blogspot.com

Source: https://www.sfgate.com/business/personalfinance/article/Step-by-Step-Lending-Club-Business-Loan-8335174.php